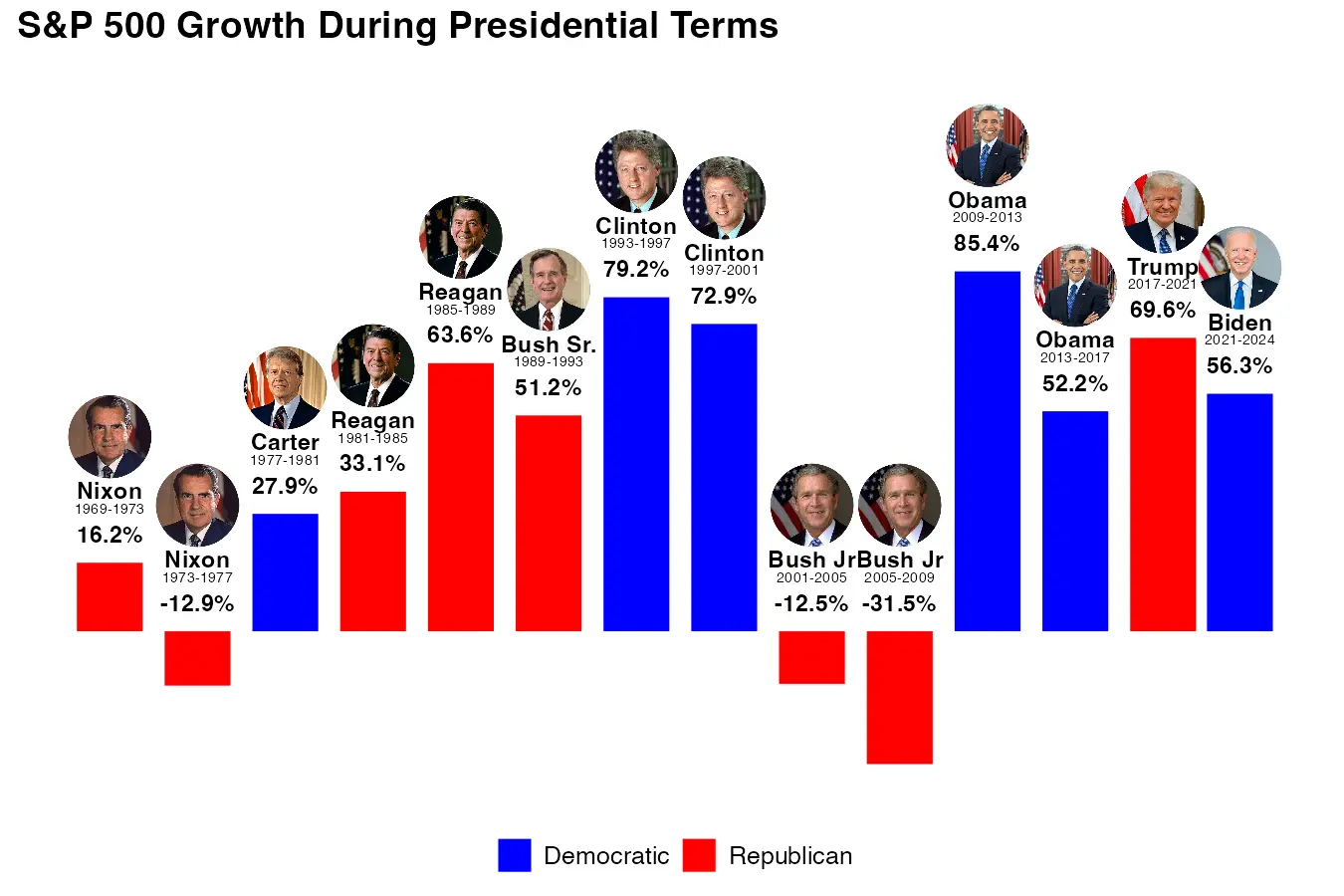

In this post I want to test an internet myth, that under a Republican president the stock market underperforms and the returns are negative. It felt like a nonsense, but I had to validate it myself. Turns out, it is… nonsense. Since 1969, there have been only 3 presidential terms, all Republicans, which resulted in negative returns over the term. But 5 out of 8 Republican terms ended with positive returns.

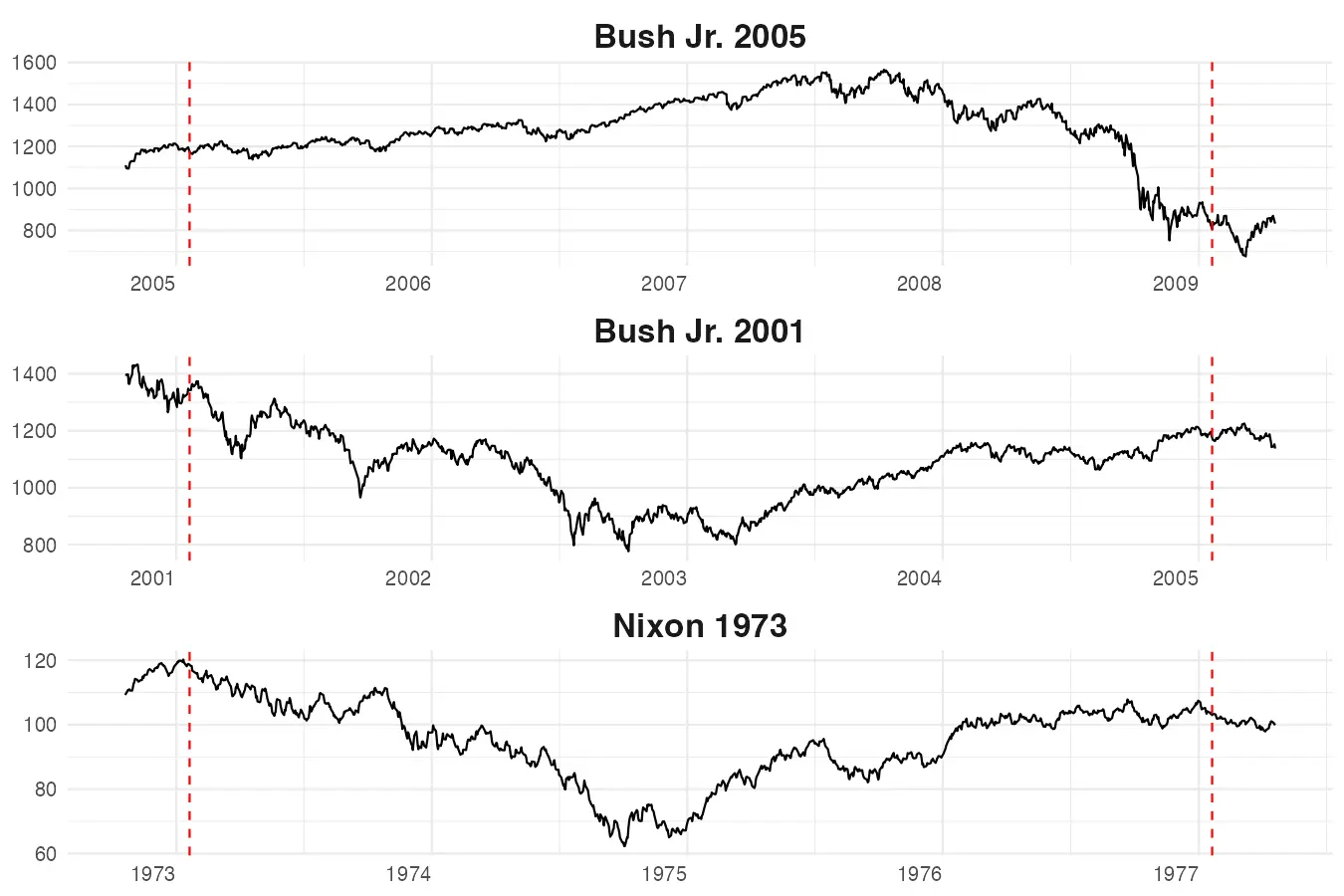

You might argue that 4 years is a long period and bearing negative returns might be painful. You might be right, but when should you sell and buy back? As the chart below shows, the stock market under Bush Jr.’s second term was doing great until it tanked at the end in 2008-2009. And it is more of an accident that the recoveries under Nixon and the first term of Bush Jr. started at similar times.

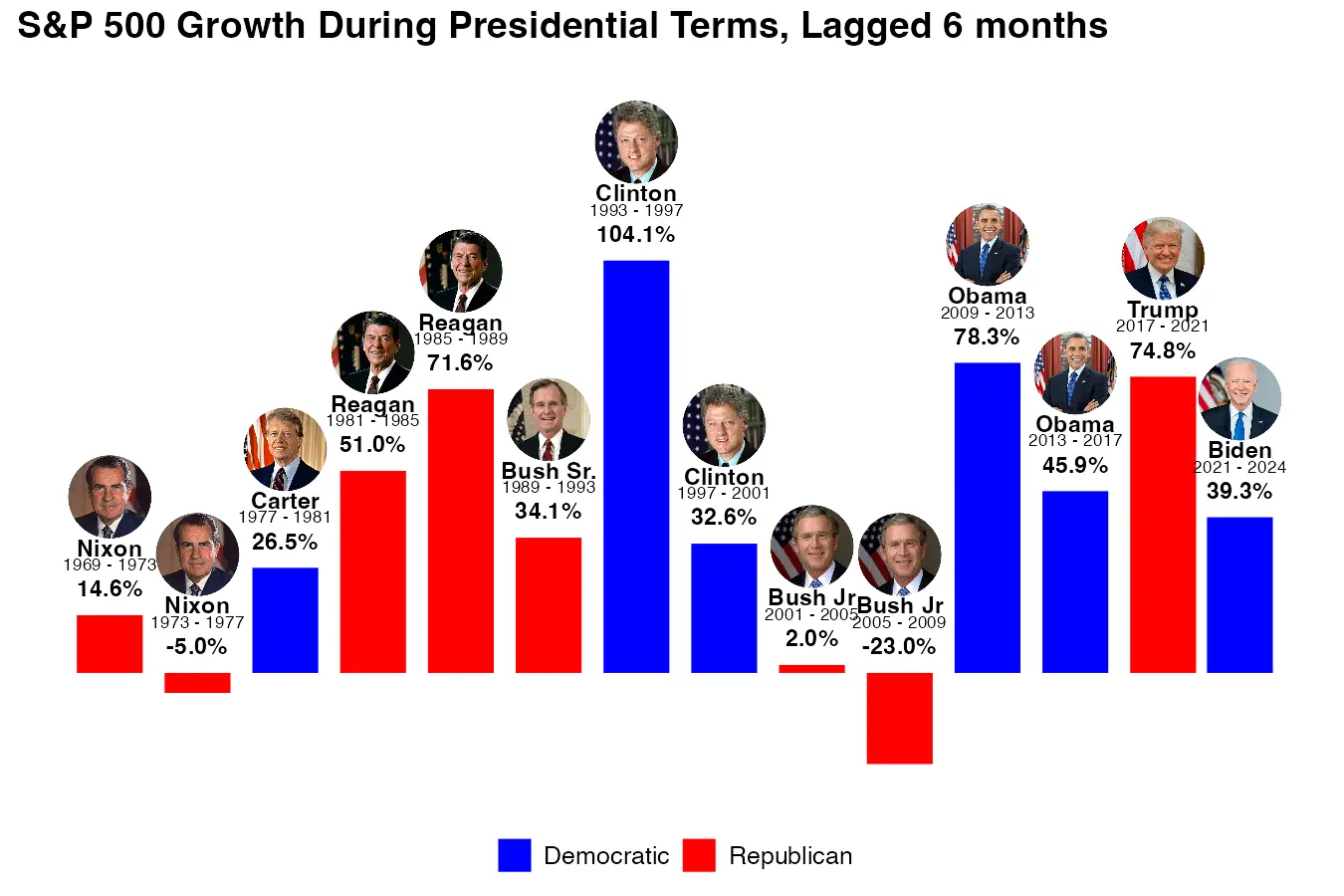

Let’s test another hypothesis - maybe a president needs time to change the course of the economy and it takes a while to kick in? How would the results look if we delay each investment period by 6 months? As per the chart below, we have some changes for each term, but the overall picture doesn’t change - a Republican president doesn’t imply a negative return.

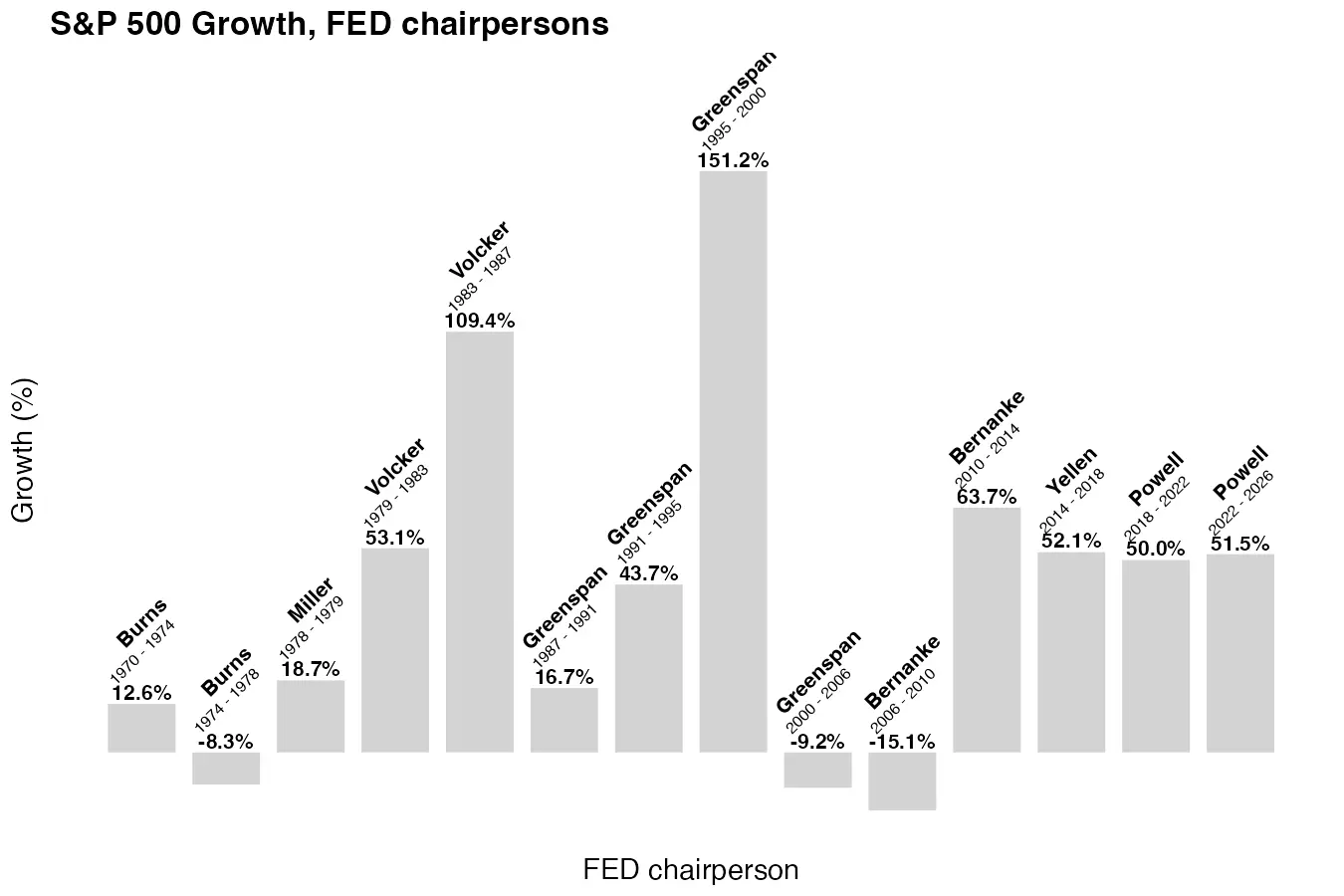

I’m surprised by how much growth we observe during any term, but it makes sense as it spans four years. Meanwhile, due to active economic crisis management by the FED, the span of a bear market has shortened to a year or two. So, maybe instead of looking at who was the president, we should be looking at who was the chairman of the FED.

The FED

The Federal Reserve System (FED) was established in 1913 with responsibilities to implement and execute monetary policy, supervise and regulate banks and maintain financial system stability. Interestingly, until the 2008 crisis and FED Chairman Bernanke, its primary levers to influence markets were interest rates, open market operations, and forward guidance. During that crisis, a new approach was added - Quantitative Easing (QE), which mainly included large-scale asset purchases and liquidity injection into the financial system. While the FED had engaged in large-scale asset purchases before, QE was an exception due to its scale. Fun fact, it’s the FED who can increase the amount of money circulating in the system - or put it differently, print money.

In a comparison, a president has tools to influence short-term economic growth, like import tariffs, negotiating trade deals, using executive orders, etc. But the president’s main responsibility is the long-term impact on the economy. Most importantly, for this post, the president nominates the FED chair, but past chairs have managed to resist demands from presidents due to the FED’s high independence. There’ve been cases where the same chairman, nominated by one president, was kept by another, regardless of political party affiliation. For example, the current chairman Jerome Powell was originally nominated by Obama as a FED governor, picked as chair by Trump, and then kept on by Biden.

The FED chairpersons’ terms do not exactly match presidential terms, resulting in different returns compared to those of the presidents. Nevertheless, the picture is clear - since 1970, only 3 terms resulted in negative returns despite very different economic challenges and unique management styles of the chairpersons. For example, chairman A. Burns dealt with the OPEC embargo in 1973-74, which led to double-digit inflation. A. Greenspan faced the dot-com bubble burst and 9/11 terrorist attacks, while B. Bernanke was tested by the subprime mortgage crisis. To summarize, the economy and stock returns are influenced by multiple forces, and just having a Democratic president is not enough to make the road less bumpy.

This post is not advice to buy or sell financial assets, just an analysis of historical data. To complicate the question even further, ask yourself: what would be an alternative to your investment during a Republican term?